The RBI has been proactive in recent years in regulating the online lending space. It has issued guidelines for online lending platforms and has also set up a dedicated working group to study the sector.

The RBI has also warned banks against lending to customers through unregistered loan apps, and it is difficult to find a legitimate lending app that is approved by a regulatory authority.

The list of registered loan apps is a valuable resource for both borrowers and lenders. It helps borrowers identify apps that are compliant with RBI regulations and it also helps lenders ensure that they are lending to customers through a registered and regulated platform.

There are various online loan applications that one could find on the internet, each one offering a different set of features and benefits.

It can get difficult to choose the correct one that fits your needs; here are the top five RBI registered loan application apps you can use to help you find the right loan for you!

Things to keep in mind while selecting a loan app:

There are many loan apps on the market with a lot of options. It can be overwhelming to figure out which is the best for your situation because everyone’s different, but there are some key things to look for that can help you make a solid decision when looking for financial support!

First, consider the interest rate and fees associated with the loan. You’ll want to find an app with a competitive interest rate that won’t put you in a hole financially.

Additionally, look at the repayment terms and see if there are any flexible options that can work with your budget.

Next, you’ll want to consider the customer support available. It’s a great sign if there is an easily accessible service team that can answer any questions or help with any difficulties that may arise.

Furthermore, it’s a huge bonus if you are able to find a loan app with a good track record for providing exceptional customer support – because no one likes to be left waiting in the dark without knowing how they will be helped when they need it most!

At last, it is vital that the loan app you choose is compatible with your mobile device. You will not face any problems while using the system if this condition is met.

Additionally, it’s helpful to find an app that offers a free trial period so that you can use it without charging yourself and see what it offers before making a final decision to use it in the long term.

Top 5 RBI Registered Loan Apps

| App Name | Navi | Home Credit | KreditBee | EarlySalary | Money View |

| Interest Rate | 9.99% – 45% | 18% – 56% | Up to 29.95% | Up to 30% | 16% – 39% |

| Tenure | 3 – 72 months | 3 – 51 months | 2 – 15 months | 3 – 24 months | 3 – 60 months |

| Fees | 2% – 4% | 2% – 5% | 2% – 8% | 2.5% & more | 2% – 8% |

| Loan Limit | Up to 20lakhs | 5000 – 5lakhs | 1000 – 3lakhs | 8000 – 5lakhs | 10000 – 5lakhs |

| Apply Link | Click Here | Click Here | Click Here | Click Here | Click Here |

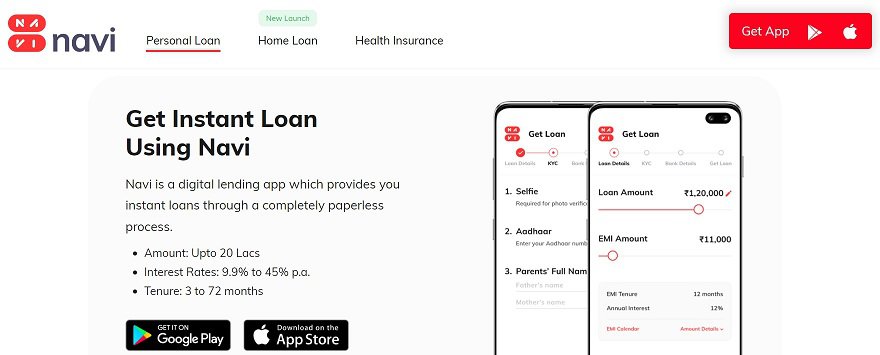

#1 Navi

Navi is an exciting app that provides borrowers with fast approval loans. Its customers can qualify for short-term lending options in as low as 45 mins, with some minimal requirements and basic documentation like photos!

The personal loans are collateral-free and feature a maximum amount of Rs 5 lakhs, which makes them a great deal for many individuals.

As borrowers may utilize this funding for anything from a large purchase to getting out of a pinch, the opportunity to repay the resulting debts in three to five years is terrific.

Navi has streamlined the loan application process to make it even more convenient. You can apply for a loan via the app without having to go through any extensive paperwork.

Now, if you have a phone with an internet connection and have both your Aadhaar number or voter ID and PAN card ready, you can apply for a loan on the app in just seconds!

#2 Home Credit

Home Credit loans are fast and hassle-free when it comes to accessing loans. They let you access money in quick time so that you can use the funds for your next big project such as a home renovation or to buy a car.

This is a financial asset of India that provides solutions to those responsible individuals who have the capability of managing their own finances by way of timely repayments at low interest raised on the loan provided by the lender.

Home credit loans come with an initial interest rate of 19% and a minimum repayment tenure ranging from 3 years but for maximum borrowing limits, one must repay within 3 years.

Home Credit loans provide consumers with the ability to borrow money quickly and easily. First, applicants must sign up online using a mobile device or download the mobile app and fill out an application form.

Once everything is submitted successfully, consumers pay their loans back in easy installments on their own schedule by setting up automatic payments.

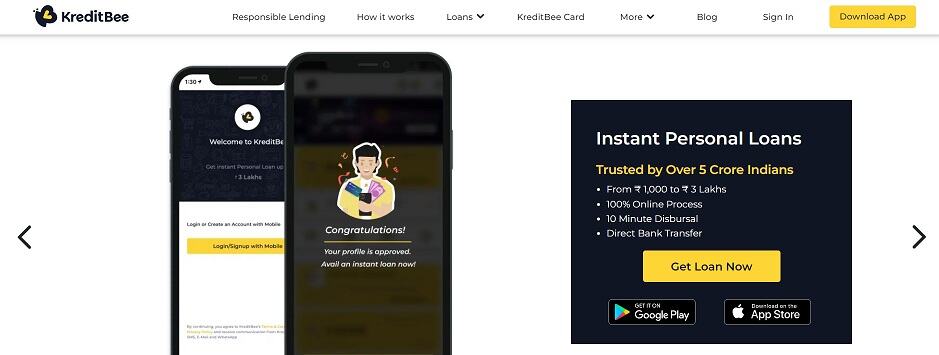

#3 KreditBee

KreditBee offers short-term loans which can be applied for and received through its online portal. Customers can avail a loan ranging from Rs. 1,000 to Rs. 150000 with tenures ranging from Up to 15 months depending on the amount of the loan applied for.

An interest rate in the range of 0% to 29.88% p.a. is charged to those who borrow money from KreditBee’s lending partners.

This partner operates using app-based technology for customers who seek fast and convenient access to this loan. This helps them get their finances in order with an instant decision even when they are away from home since the submission process doesn’t require any paperwork or documentation.

You have to keep in mind that you will not be eligible for high amounts of loans at the get-go.

Therefore, you need to start applying for smaller loans and repay them on time, upon which your limit will gradually increase and make you eligible for larger amounts of loans.

#4 EarlySalary

EarlySalary is a unique lending platform that provides an innovative approach to bridging salaries to meet your budgeting commitments. The EarlySalary enables you, the borrower, to get a short-term bridge loan which works out to around two weeks of salary.

This helps you get by until your next payday. With EarlySalary’s unique service, you can leverage up to 5 Lakhs rupees for any max duration of 3 years at flexible repayment plans worth your while.

Early Salary is a revolutionary concept in the personal loans sector that can help you borrow at an interest rate starting from a mere Rs. 9 per day!

Regardless of your credit profile and loan tenure, you can take advantage of this extremely low rate.

Early Salary’s minimal processing fee means you need not pay any extra charges when taking out this loan.

#5 Money View

Money View provides loans that come with zero paperwork and get approved in a few hours for personal loans. With an innovative application process and quick turnaround, you’ll never have to worry about handling all of your busy financial tasks ever again.

You can get a casual loan from Money View – two hours or less! Say for example you want to remodel your home, buy an expensive ride, or cover your wedding expenses.

No matter what your reason is for taking out a personal loan, we’ll get it done quickly and diligently with their quick loan services.

At Money View, they specialize in making the whole experience super simple and easy even if you’ve had trouble getting approved for a personal loan elsewhere.

also check: Top 3 EMI cards which you can apply without any credit score

Final Thoughts

Getting a loan can sometimes be more challenging than it should be.

In fact, one might feel overwhelmed by the number of options available for choice.

However, you needn’t worry because we’ve found lenders whose services are not only approved by regulatory institutes like RBI but are secured as well.

We recommend borrowing money from these RBI Registered Loan Apps to help you get ahead faster and gain momentum in the best way possible.

For More Information

1. All India list of NBFCs including RNBCs, to whom Certificate of Registration under Section 45 IA of RBI Act, 1934

have been issued by the Reserve Bank of India to hold / accept deposits from public.

https://www.rbi.org.in/upload/publications/pdfs/59260.pdf