Tax season can be a pain, but these Best Apps for ITR Filing can help make it a little easier.

It is that time of the year again when individual taxpayers have to file their income tax returns (ITR). Gov has made in tax regime and introduced old and new tax regime .

For many, it is a daunting task as they have to collate all the required documents, fill up the ITR form and submit it to the Income Tax Department.

However, filing ITR is not as difficult as it may seem.

Various online and offline resources can help taxpayers with the process. The Income Tax Department has also made it easier to file ITR by introducing e-filing.

Taxpayers can now file their ITRs online without having to visit the tax office.

What is ITR filing?

Every person or organization in the country who earns money has to pay taxes on that income to the government. This includes individuals as well as firms, LLPs, local authorities, associations, and Hindu undivided families.

For each financial year, income tax is filed by submitting an Income Tax Return (ITR) form to the Income Tax Department of India. The ITR contains information about an individual’s income and taxes payable for that year.

Reasons why you should file your ITR on time:

Legal Action

When it comes to filing your ITR, it’s always better to be safe than sorry. If you’re running late on filing your ITR, the IT department may shoot you a notice. If the Income Tax department isn’t content with your response to the notice, you could land yourself in some legal trouble. To sidestep this issue altogether, make sure to file your ITR punctually.

Avoid Penalties

Punctuality is key when it comes to filing your ITR. Just like with most things in life, if you’re late to the party there’s usually a price to pay – in this case, a penalty from the department. Of course, it’s not just a matter of avoiding a penalty – filing your ITR on time is important in and of itself. So be sure to set a reminder or two so that you can avoid any delays and make sure your paperwork is submitted on time!

Carry Forward Losses

According to the Income Tax rules, if you file your Income Tax Return before the deadline, you’re allowed to carry over your losses to the next financial year. This could help lower the amount of taxes you owe on future incomes.

Best Apps for ITR Filing

If you’re looking for a way to make tax season less painful, check out these tax filing apps.

| Best Tax App | Download Link |

| Black by Cleartax | Android | iOS |

| All India ITR | Android | iOS |

| TaxBuddy | Android | iOS |

| Tax2win | Website |

| Glyde | Android | iOS |

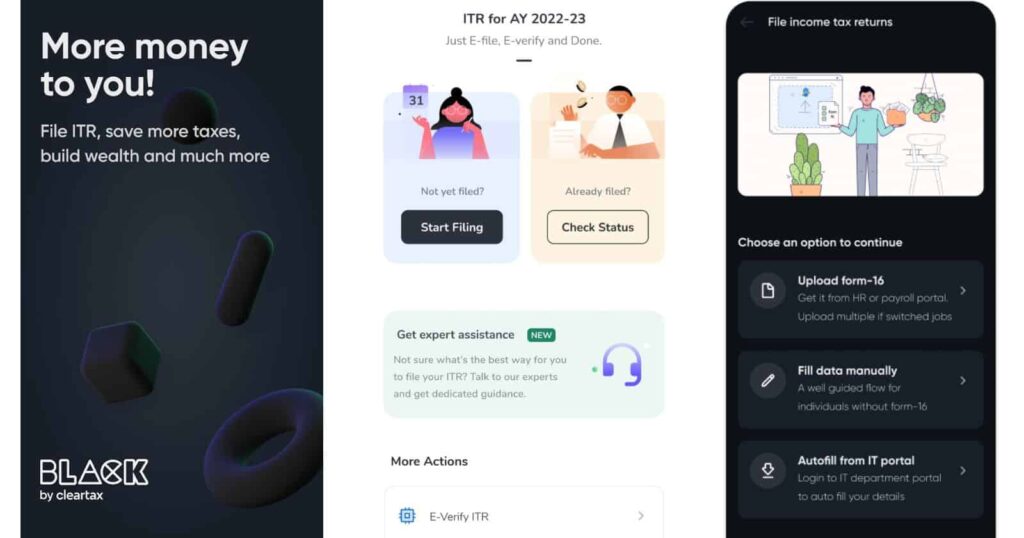

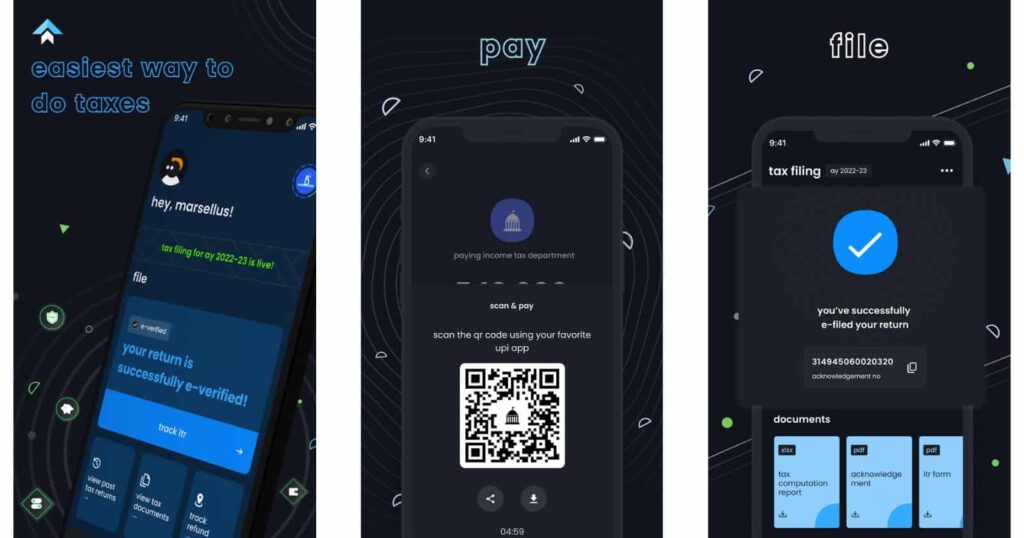

Black by ClearTax Tax Return App

ClearTax is an app that makes filing your taxes a breeze. It offers a variety of features that make it stand out from the competition. One thing that ClearTax does is allow users to fill in all the details in separate dialogue boxes.

This makes it extremely easy to use and helps to keep track of everything. Additionally, ClearTax also allows users to upload Form 26AS and Form 16. This makes it even easier to file your taxes and ensures that everything is taken care of.

Features of Black Tax Return App

- Completely paperless and hassle-free ITR filing

- The Income Tax Return (ITR) process with ClearTax is extremely easy, hassle-free and convenient.

- ClearTax will automatically fill in the required details and you can review them.

- The entire process is extremely quick and very user-friendly.

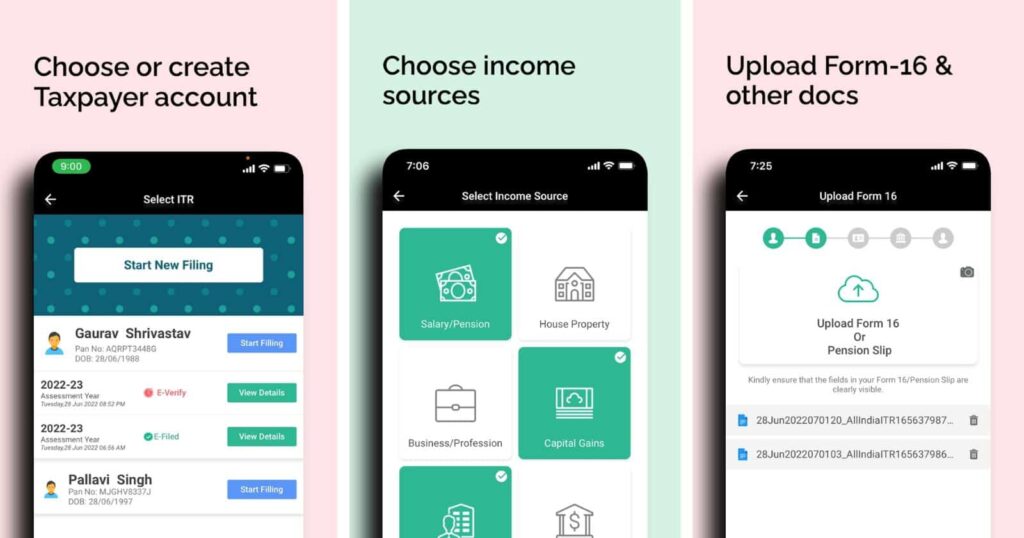

All India ITR Tax Filing App

You no longer have to search for a CA to file your ITRs and pay him/her hefty fees. The ITR filing is now made easy with the right app in hand. All India ITR app is a lifesaver for all taxpayers who are looking to get their returns filed in time.

You can eliminate the need for paper documents when you file your taxes by simply uploading Form 16 and any other required documents onto their server. The app will read all of the necessary details and begin the process for your tax return.

Features of All India ITR Free Tax App

- The app is really easy to use and does not require any previous knowledge of ITR filing.

- The app automates all the processes and it is necessary for the user to just enter the data.

- It’s a very user-friendly app that saves users time and money.

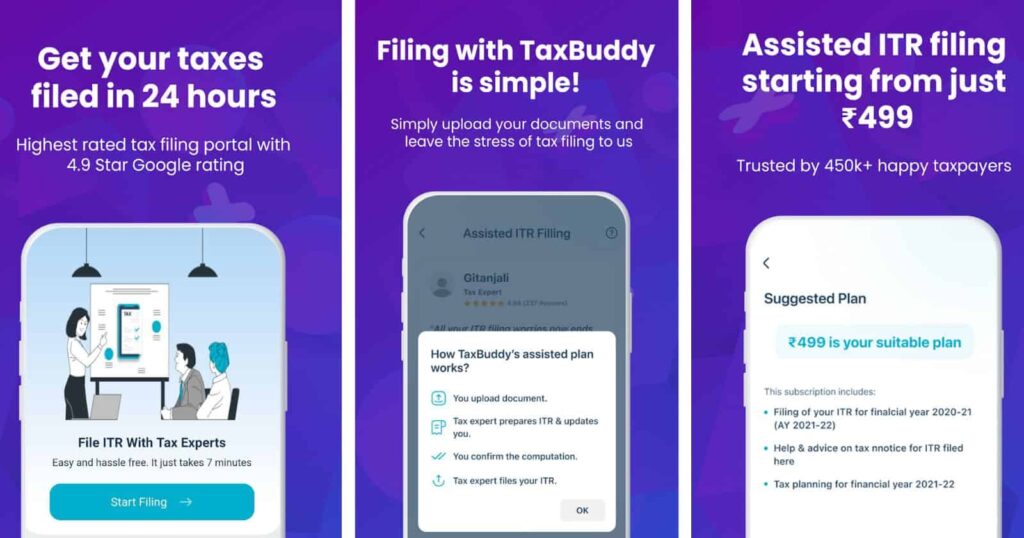

Taxbuddy

Filing your taxes doesn’t have to be a headache. You can file your ITR without all the hassle of visiting your accountant for assistance. Taxbuddy is a secure and easy-to-use tax filing platform that offers several features and benefits to taxpayers. With Taxbuddy, you can eliminate the hassle of notices and compliances, and enjoy accurate filings at a low price.

Taxbuddy also provides free tax planning services, along with CA-assisted income tax filing, GST filing, and notice management. Plus, their customer support team is always available to help you with any questions or concerns you may have.

Features for Taxbuddy

- File ITR from the comfort of your home & submit the same to the income tax authorities using this app

- The app has the best tax expert who knows all of the necessary details required and guides the users while they file.

- This app guides you in the right direction whenever you are in doubt about any query related to income tax.

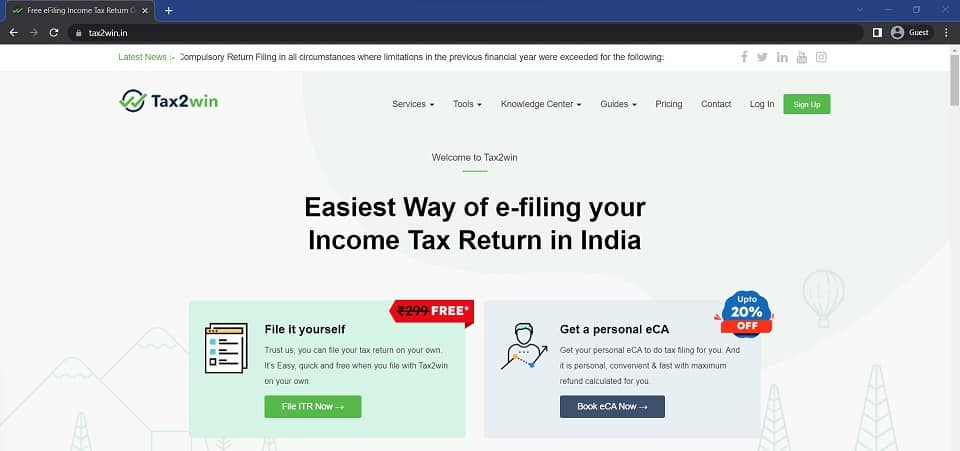

Tax2win

If you’re looking for the easiest way to e-file your income tax return in India, look no further than Tax2win. Not only is their service fast, but it can also save you a lot of money and time. If you’re not familiar with tax law, Tax2win is the perfect solution for you.

Their team of professionals, most of whom are certified chartered accountants, are ready to help. When it comes to data accuracy and security, you can rest assured that Tax2win is the best in the business.

Features for Tax2Win

- Fast, Reliable & Secure

- Get Maximum Refunds

- All-In-One E-Filing Solution

- Hassle-Free Tax Filing

- Authorized by Income Tax Department

Glyde

Glyde is an easy-to-use tax filing service that provides a step-by-step guide to help you file your return from the comfort of your own home. With Glyde, there’s no need to worry about traveling to a tax office or dealing with complex paperwork – everything is taken care of for you.

Professional chartered accountants and tax preparation experts are on hand to provide impeccable service and ensure your data is always secure. Just sit back, relax, and let Glyde do the work for you.

Features for Glyde

- Get your tax returns done in no time

- Most cost-effective ways to file your income taxes in India

- Convenient and Time-Saving

- Fastest growing, most reliable and trusted tax service in India

Final Thoughts on Best Free Tax App

If you’re not able to visit a chartered account due to some work or any emergency, it can be a bit challenging to file ITR.

Fortunately, these ITR filing apps can offer a hassle-free solution by providing accuracy, transparency, and above all, convenience.

These apps can help you file your taxes quickly and easily, without having to worry about any of the paperwork or legwork.