Hey Guys , Good New for all Of us Flipkart Offering EMI through Debit Cards which was a Huge news for all Flipkart users It Open a way to normal users who don’t have credit cards and want to Buy their Favorite product in Easy Installment.

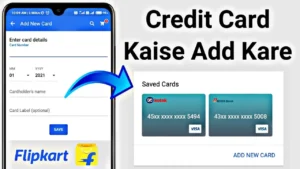

The Best thing About Flipkart Easy Installment Program is that You do’t need to Submit any Document or any down payment or Any processing Fees .You have To Just do Normal Shopping and Choose Easy Installment Option On payment page and there you can Choose Monthly EMI and Pay Via Debit Card.

Also Check: Steps To Buy Amazon Products Through Debit Card EMI (With FAQ’s)

Which Bank Allowed For EMI Now On Debit Card Offer:

This is important Guys As you know Flipkart Just Launch This Program So All bank are Not Eligible But Bank which are eligible I am sure You have account one of them for Sure. So below is the List which Bank customer allowed For This program.

- State Bank Of India (SBI)

- AXIS BANK

- HDFC Bank

- ICICI Bank

If This Program successful Flipkart add More Bank in their List Too.

![Best Sweater For Women Under 500 [Top 7 Brands] 8 Best Sweater For Women Under 500](https://www.earticleblog.com/wp-content/uploads/2022/11/Best-Sweater-For-Women-Under-500-300x158.jpg)