EMI on Debit Card means the use of Debit Card like Credit Card. Here we are sharing SBI Debit Card EMI Offer for Flipkart. We have written a step-by-step procedure to activate SBI Debit Card EMI Offers.

Ever thought of buying a smartphone but stopped yourself due to the high price. Sometimes we don’t have enough money at that particular moment. So EMI on SBI Debit Card turns out to be a solution to this problem.

The main highlight about Equated monthly installment is that you are not required to have the whole amount in your SBI Bank account.

How to Get EMI on Debit Card?

You just have to pay a small amount on a monthly basis. You can pay your EMI tenure in 6, 9 or 12 months with an interest of 14 percent. Some banks even provide No Cost EMI option.

The good thing is that you won’t be charged anything that is No Processing Fee. Moreover, there is no documentation required. For availing EMI facility, you need to purchase a minimum of Rs. 5,000. A maximum limit on SBI Debit Card EMI is Rs. 75,000. You can have one EMI per SBI Bank account.

Use of SBI Debit Card As Credit Card

The main benefit of having a credit card is to purchase for something online and pay back in installments. Same concept is now being projected towards EMI facility on Debit card.

SBI Bank account is one of the most popular banking services in India. It is used by millions of users and all of them is SBI Debit Card holders. With this facility you can get full experience of online shopping without worrying about money.

All you need to do now is purchase any product online and choose EMI without Credit Card as payment method. After that choose your desired bank which is activated without Credit Card EMI. Complete the payment procedure after choosing the months of installments.

Your bank will start deducting money according to your installment months. All you need to do is to make sure you have the minimum amount available in your bank account.

Now, are you thinking to buy your next smartphone on EMI?

Buy Smartphone on EMI without Credit Cards

Online shopping of smartphone is a new trend and eCommerce websites like Flipkart or Amazon India facilitates this need.

One Last thing I wanna Share after New EMI service on Amazon and flipkart. Both are launching specific Credit cards in partnership with ICICI Bank & Axis Bank where they are giving up to 5 % cashback on every month on shopping which are very good offer if you are daily shopper.

Now before going ahead, let us make this clear that SBI doesn’t allow everyone as EMI eligible. According to your credit history, they choose whether you would be eligible for SBI Debit Card EMI on eCommerce website purchase.

Recommended: How to Check CIBIL Score Free

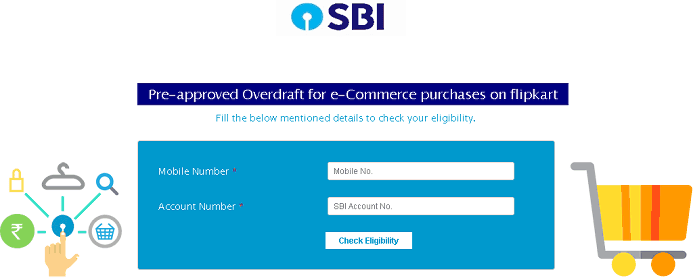

So how to check whether you are eligible for EMI facilityon your SBI Debit Card?

How to Check SBI Debit Card EMI Eligibility

-

Click to check eligibility – SBI Flipkart Eligibility Page

-

Or copy this – https://onlineapply.sbi.co.in/personal-banking/sbi-flipkart

-

Enter your mobile number to check pre-approved overdraft for e-commerce purchase on Flipkart.

-

Now enter your SBI account number.

-

Click on “Check Eligibility“.

-

You will receive OTP Code from SBI.

-

Enter the OTP and click proceed.

-

You will receive another message from SBI with your credit limit.

-

Finally, purchase item according to your credit limit.

If this method doesn’t work then here is an alternative –

- Add your SBI Debit Card to Flipkart Account under settings.

- Now on the payment page, you will see EMI.

- If under you see Standard EMI /Pre-approved EMI tab with State Bank of India as an option. Then you are eligible to get EMI on mobile phones if you comes under SBI Debit Card holders.

SBI Debit Card EMI Eligibility via SMS

Another alternate method is to send SMS to know the eligibility.

Different banks have different numbers. Like for HDFC Debit Card, all you need to do is send a message from the registered mobile number. You have to send DCEMI to 57575 to know EMI eligibility.

For other banks send SMS in this format from the registered mobile number –

DCEMI <Last 4 Digits of Debit Card> to 56767

For Example – DCEMI 1234 to 56767

Check Out: How to Get HDFC, ICICI, SBI Debit card EMI on Flipkart

How to Buy Online Mobile on EMI without Credit Card

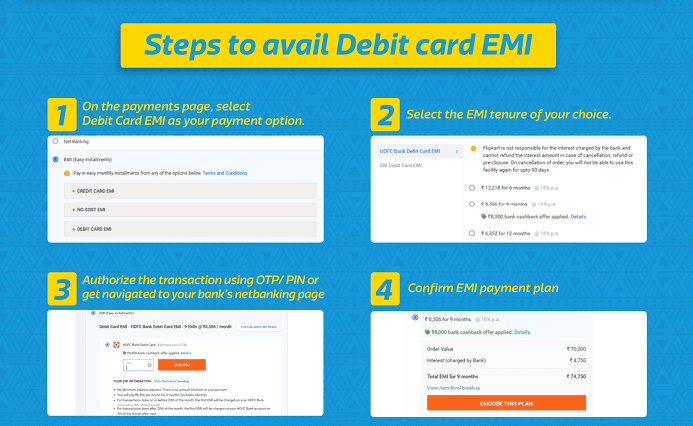

EMI on SBI Debit Card for Mobile Phones: Buying on e-commerce website using EMI is quite simple then you think. Here is the step-by-step procedure to buy smartphone using SBI EMI Debit Card.

| S. No. | EMI on Mobile |

|---|---|

| 1. | Samsung Mobiles |

| 2. | Mi Phones |

| 3. | Honor Mobiles |

| 4. | Apple Phone |

| 5. | OPPO Mobiles |

| 6. | Asus Smartphones |

| 7. | Vivo Mobiles |

-

At first, you have to go to Debit Card EMI Store – Flipkart EMI Eligible Product Page.

-

Add your favorite smartphone to the cart.

-

Remember that you can only buy one item for EMI eligibility.

-

Go to “Cart” and click on “Checkout”.

-

On payment page choose “EMI (Easy Installments)” option.

-

Under EMI option, click on “Pre-Approved / Debit EMI” option online shopping in Flipkart.

-

Select “State Bank of India”.

-

Finally, enter Debit Card details and OTP to make transaction successful.

Let us show you this with an example (sbi emi debit card mobile store) –

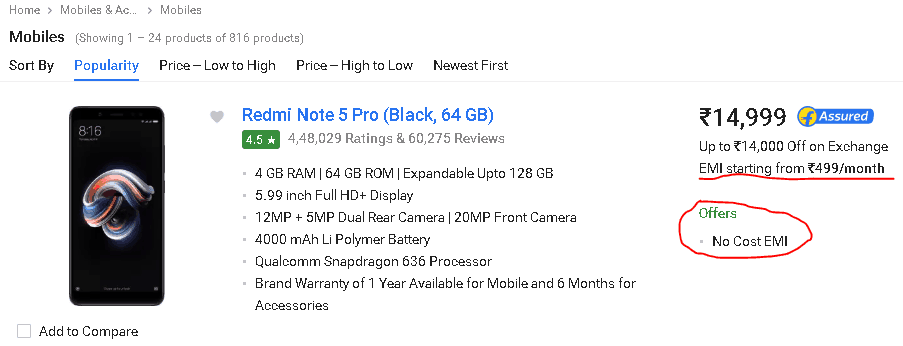

1) At first, I opened the EMI eligible product page on Flipkart.

2) Then clicked on Mobile phone option. If you are looking for something else other than smartphone then go for it.

3) Now on EMI eligible Mobile phone page, I clicked on Redmi Note 5 Pro smartphone.

4) There are two banks which are providing No Cost EMI on this phone. Bajaj Finance and HDFC Bank. Here we are going with the “Standard EMI” option.

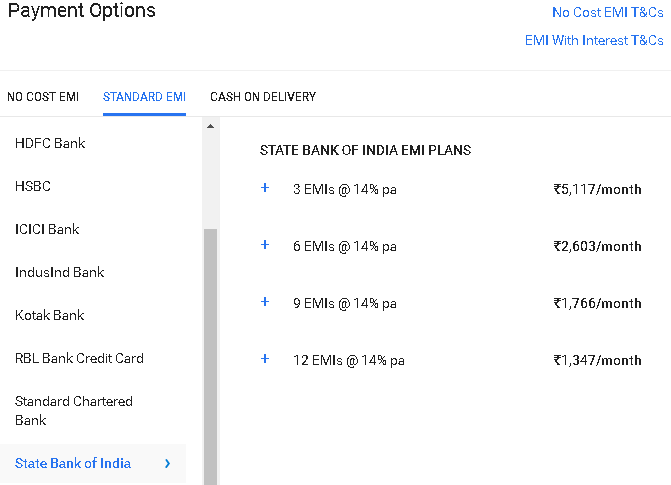

5) I chose State Bank of India, which is taking a 14% interest rate. There are 4 EMI plans for SBI Bank Users. 3, 6, 9 and 12 EMIs.

6) On Payment Page, if you are eligible you will be able to choose EMI option and select SBI Bank Debit Card (this have to be pre-saved in your account).

7) I chose 9 months plan for which I have to pay Rs. 1766 per month for 9 months.

EMI with SBI Debit Card Terms & Conditions

Before going ahead with EMI for State Bank of India Debit Card you should check out these terms and conditions. Information like interest rate, minimum purchase or maximum pre-approved overdraft allowed limit is provided below.

- You can avail EMI with SBI Debit card for a maximum of one product at a time. That means, suppose you are buying a smartphone then you can only purchase 1 at a time in order to use EMI option. This is done in order to stop bulk purchase for reselling purpose

- Minimum purchase is Rs. 5000 in order to get eligible for EMI Payment mode

- The maximum limit for the pre-approved overdraft is Rs. 75,000

- EMI option comes with 3 plans. Either payback emi tenure in 6, 9 or 12 months. You will be charged a 14% interest rate for all tenors.

- The good news is that you won’t be changed anything as processing fees. Moreover, there is no cancellation charge up to 30 days from the purchase.

Also, Check:

I hope you liked this post on how to get mobile on EMI without credit card. All you need is a pre-approved SBI Debit card. It should have proper overdraft limit and you are good to go. Share your thoughts and queries regarding EMI on Debit card down below.

it was easy to buy smartphone or any other thing with easy emi. great

web site indexletme.

4

nice greate information bro

Realms c2 emi para layna ha

how to activate debit card emi in sbi

By sending the message will they approve me for emi eligibility

By sending SMS, you will know whether you are eligible or not.

I have rupay sbi debit cacard. But in amazon it shows this card is not eligible.

Please suggest me which card to prefer

try different card

Same goes to me

Emi e commerce details error sow kar raha h

ak sms wala method bhi hai jisse emi ki eligibility check kar sakte hai

Thanks, Vasant bhai, I have updated the post with a method to check Debit Card EMI Eligibility by sending SMS.

Is this applicable to all four HDFC, ICICI, AXIS and SBI Bank Debit Cards?

Yes this process is valid for all four debit card mentioned by you :)

I was looking for how to buy Samsung mobile on emi with debit card thanks for sharing this

Your welcome Anuj :)