Hello Readers ,In this post we are going to express our views on EMI Cards which offers consumers to buy products on Monthly Installments . Since Credit Card market has boomed by 300% in last 3-4 Years , EMI term has came into limelight .

As we know that Banks or Card issuers give Credit Cards to Salaried & Business Professionals only . So For students & other Freelancer people EMI Card is the easiest way to get consumer durable loans .

Getting credit card and using it smartly is very important these days , for student credit card is like life saver but we have to use it wisely. Today we gonna share some cards which you can apply and get without credit score so try it.

What is EMI Card ?

EMI Cards are just like Credit Cards but are accepted at very limited Outlets or Websites . You have to choose monthly payment option while making purchase .

You can use EMI Cards against purchase of Goods such as Electronics and on Flights bookings etc.

The purchase made through EMI Card needs to be paid on monthly basis & it can attract higher charges if you miss any repayments . So , EMI Cards are good only if you have regular flow of income .

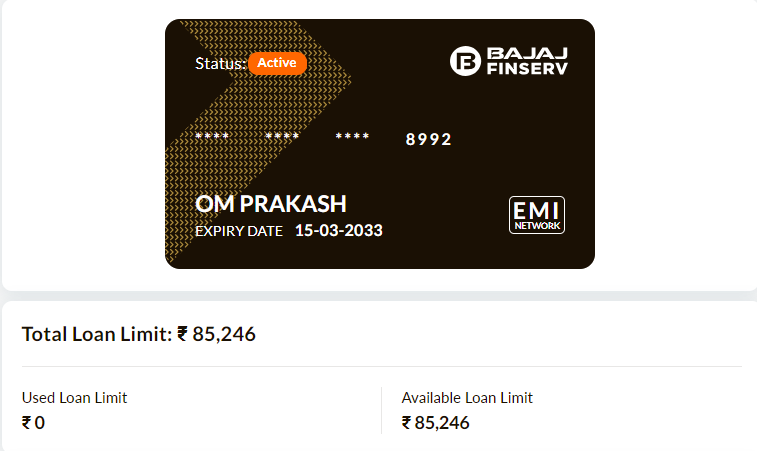

1 . Bajaj Finserv Insta EMI Card :

Bajaj Finserv is one of the leading EMI Card for purchases of consumer goods online as well as offline .

| EMI Card Fee | INR 590 |

|---|---|

| Processing Fee | INR 117 For Each Loan |

| Annual Fee | INR 117 |

| Convenience Fee | INR 69 On Each Loan |

| Addon Card Fee | INR 199 |

Steps To Apply For Bajaj Card :

- First of all , Visit Bajaj Finserv application portal from HERE

- Now , Enter your Mobile Number & verify it

- Enter details like PAN Card , Name , Age , Gender

- Now , It’ll show the credit limit that has been offered to you .

- After completing Personal details proceed to Digi locker KYC

- Now , Proceed to make INR 599 EMI Card Fee Payment

- At End , They’ll ask for activating E-Mandate ( NACH ) through your bank account

NOTE : First transaction on Bajaj Insta EMI Card can be done on offline outlets only which accepts Bajaj EMI Cards . Also, First transaction can be done only in your local city within 10KMs range .

Online transactions on Bajaj Insta EMI Card generally gets enabled after a month of doing offline transaction .

Also Check : List Of Banks Which Charges Processing Fee On Rent Payments Via Credit Card

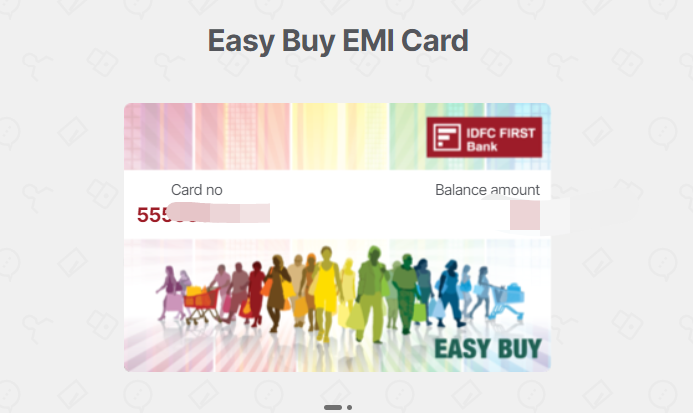

2. IDFC Easy Buy EMI Card :

IDFC Offers Easy Buy EMI Card for its customers to purchase consumer durable in convenient way . Its Easy Buy EMI Card can be used at few online merchants and various offline retailers .

| EMI Card Fee | INR 499 |

|---|---|

| Processing Fees | As Applicable |

| Annual Charges | INR 99 |

| EMI Bounce Charges | INR 400 |

| Foreclosure Charges | 5% Of Outstanding Amount |

Steps To Apply For IDFC Easy Buy EMI Card :

- Firstly , Visit IDFC’s Consumer Durable Loan Page From HERE

- After that verify your Mobile Number with OTP

- Enter all required details like PAN Number , Date Of Birth , Residential & Employment Details

- Now , Proceed to Documentation & Credit limit will be assigned you for shopping .

- You can use your IDFC Easy Buy EMI Card Online too .

Also Check : How To Foreclose ICICI Bank Credit Card EMI Online

3. Kotak Smart EMI Card :

Kotak Mahindra Bank offers EMI Card for its Offline Customers . One can use The Smart EMI Card to make purchases through various categories on Offline Partner Stores .

| EMI Card Fee | INR 499 |

|---|---|

| Annual Fee | INR 299 |

| Processing Fee | INR 99 To INR 2999 |

| EMI Bounce Charges | INR 500 + GST |

| Foreclosure Charges | 4% + GST |

Steps To Apply For Kotak Bank Smart EMI Card :

- Firstly , Visit any of the tie up stores

- Select the product that you wish to purchase and ask for the Kotak Smart EMI Schemes

- Take the necessary details from the store assistant , You can check eligibility criteria from HERE

- Complete the digital loan process and make the required amount for Down Payment

- An OTP will come to authenticate every future transactions on your Smart EMI Card .

Final Words :

So guys , In this post we have covered about Bajaj Finserv EMI Card , IDFC First Easy Buy EMI Card as well as Kotak Bank Smart EMI Card . In most of cases EMI Cards doesn’t require any higher Credit Scores and it proves to be a boon for Students and non-salaried people .