UPI App: Here we are dealing with all information regarding UPI, a new sensation in fund transfer and online transaction system. UPI stands for Unified Payment Interface which is introduced in order to facilitate faster and more reliable transaction.

Moreover, Govt. of India introduced UPI in order to make India more Digital with Cashless transactions.

UPI full form is Unified Payment Interface which is the successor of IMPS (Immediate Payment Service) which helps you in sending money to anybody within your bank or other bank instantly.

Recently we have shared PhonePe app loot where sending Rs.1 Via UPI you can get Rs.50 back in bank account.

With UPI you do not have to worry about giving Account Name, Bank Account Number, Branch or IFSC Code to the sender or you do not have to take the same if you are sender. All you need is an alias means an ID which looks very similar to Email address.

Example for UPI ID: username@bankname

What is Unified Payment Interface & How it Works

UPI is introduced by NPCI (National Payment Corporation of India) which deals with fund transfer and Raghuram Rajan (Gov, RBI); and they introduced it in order to make fast, secure and more reliable way of sending money from one bank account to other immediately.

UPI is one of the best innovation in 21st centuries because you can transfer fund within 2 second from one bank account to another via mobile and without going any bank.

Also UPI is favorite banking app of all Indian users because it is easy , trusted and backed by RBI.

So basically all you need is a small UPI code to send or receive money from someone or soon you will be able to use it for online shopping or any online transaction as everyone implements it in there payment system.

You Might Also Like: BHIM App Download: How to use it for UPI Payment [by MODI]

Benefits of using UPI (Unified Payment Interface):

- Send or Receive Money from one Bank to other INSTANTLY.

- No need to remember Account Number, IFSC Code.

- You have to choose your own unique UPI ID Code.

- You can create any number of UPI alias.

- You can send or receive money anytime you want (24 x 7).

UPI comprises of all benefits and features of IMPS like you do not have to add beneficiary before sending money and your money will be transferred instantly to the receiver.

You can also define it under Digital India movement since you are creating progressive cashless society by using online medium to do payments for online & soon offline transactions (like in shops or malls).

Moreover after demonetization everyone are well aware about the value of cashless transaction which is currently popular in India by using paytm at shop, taxi, etc.

Since it’s just now born in the payment system so you might have to wait for a while for your Bank to bring this in the service. But many Banks like ICICI, AXIS have already implemented it in their mobile banking app.

Also check : Best UPI Payment Apps in India(Special Offer Inside)

UPI App Free Download for All Banks

| Bank with UPI | UPI App Free Download |

|---|---|

| UPI ICICI App | Click Here |

| PNB UPI | Click Here |

| SBI UPI App | Click Here |

| HDFC UPI App | Click Here |

| Andhra Bank | Click Here |

| Axis Bank | Click Here |

| Bank of Maharashtra | Click Here |

| Union Bank of India | Click Here |

| YES Bank | Click Here |

| PhonePe | Click Here |

Banks providing UPI support enabled mobile application are Andhra Bank, Axis Bank, Bank of Maharashtra, Bhartiya Mahila Bank, Canara Bank, Catholic Syrian Bank, DCB Bank, Federal Bank, ICICI Bank, TJSB Sahakari Bank, Oriental Bank of Commerce, Karnataka Bank, UCO Bank, Union Bank of India, United Bank of India, PNB, South Indian Bank, Vijaya Bank and YES Bank.

So now you have UPI Apk for your Bank so you can proceed to create your UPI ID.

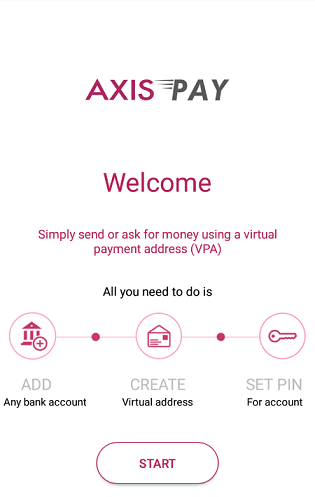

Below I am showing few screenshots for ICICI Bank and AXIS Bank. For rest other banks the procedure will be same.

How to Create UPI ID (Virtual Address)

- Download UPI based app from above table for your bank.

- Open your Internet banking account or Add your bank account.

- Now create Virtual Payment Address or UPI ID. [Ex.: yourname@axis OR example@pockets]

- Now finally set a PIN for your account.

How to Send Money using UPI ID?

- Login to Pockets app and tap on ‘UPI’.

- Click on ‘Send Money’ using VPA (UPI).

- Fill in details, amount and remarks. If you have multiple accounts / virtual payment addresses, choose the VPA you would like to debit.

- Check the details and click on ‘Confirm’ to initiate your Fund Transfer.

How to Receive Money through UPI Virtual Address?

- When someone send request for payment, you will get notification in your phone.

- Alternatively, login to your Bank UPI App and click on the UPI section.

- Then simple choose ‘Respond to Collect Money’.

- Choose the VPA from which the payment needs to be made.

- Your account will be debited when you click on ‘Confirm’ for same Bank.

- If you have chosen another bank account, you will be asked to enter your UPI PIN of the bank account.

- After verification, funds will be transferred instantly to the beneficiary.

At first it looks like complicated but once you get used to it then it will be the most easiest way for you to send or receive money to / from your loved ones or relatives or any business clients without asking or giving account number and other bank details.

UPI just acts as an e-mail ID which will be unique identifier (like tokens) that your bank will utilize to transfer money from / to same or other Bank instantly and securely. All you need is Aadhaar unique identity number, mobile phone number or virtual payments address without entering bank account details.

Here is the Prime Minister Shri Narendra Modi Ji addressing about UPI and its benefits in future of India:

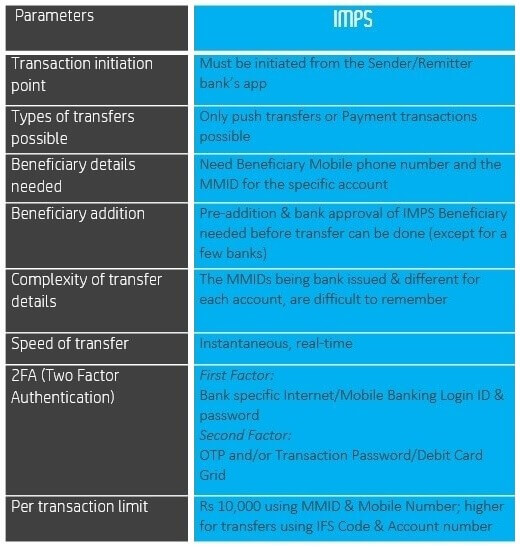

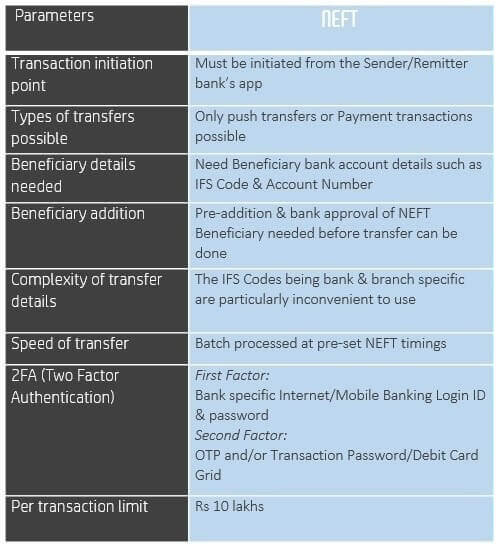

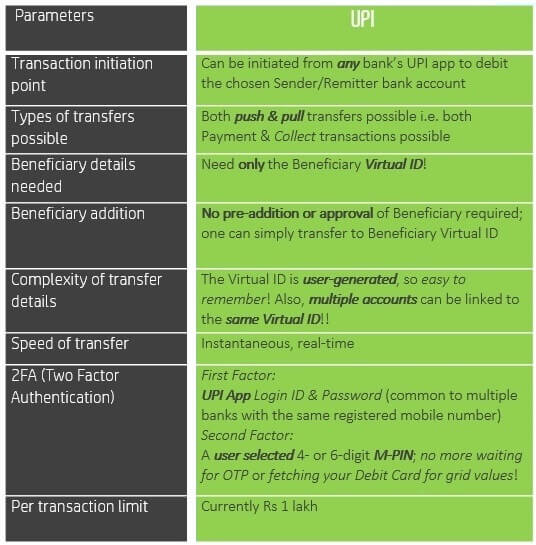

Now if you want to know the difference between NEFT, IMPS & UPI check below image.

NEFT vs IMPS vs UPI

Key Points about UPI Payment Mode:

- Per Transaction Limit: 1 Lakh Rupees.

- Send / Receive Money from Any Bank to Any Bank.

- Need only one simple Virtual UPI ID for transaction.

- Instant Transaction.

We will soon update this post with Hindi content but until then you can watch this awesome and well explained video on UPI by Technical Guruji.

UPI by PayUMoney:

I hope liked the above article on UPI that is Unified Payment Interface, the latest payment system which is more reliable and faster then predecessors. You can send money from or to any bank instantly by paying a negligible upi charges / fees of 50 paisa ( Half Rupees ).

Share your views on UPI payment system and how you feel that it will help us in future. If you have any doubts then feel free to leave a comment below and we will get back to you with solution regarding Unified Payment Interface as soon as possible.